Click the chart for more stock market data

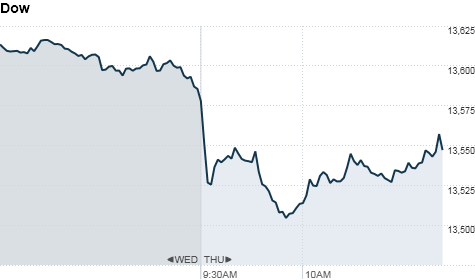

NEW YORK (CNNMoney) -- U.S. stocks logged modest declines Thursday, as disappointing reports in Asia and Europe showed further signs of slowing global growth.

Dow Jones industrial average, S&P 500 and Nasdaq were down between 0.3% and 0.5%.

An HSBC report on Chinese manufacturing showed that manufacturing in the world's second-largest economy continued to contract in September. That's worrisome for U.S. investors since China is the world's second-largest economy and many U.S. companies have a big presence in the country. The weak report pushed Asian stocks down between 1% and 2%.

European markets also came under pressure after a regional purchasing managers index fell to a 39-month low. Economists had expected the index to show a slight uptick in business activity.

ING Bank economist Martin van Vliet called it "an unpleasant surprise," adding that it "quashes hopes for an imminent end to the recession."

Related: Best stocks to own if you're betting on Romney

The news wasn't any better in the U.S.

The Labor Department reported a bigger decline in first-time unemployment benefit claims in the latest week. And, at 382,000, the number is still not low enough to ease worries about continued high unemployment.

Firms responding to the September Business Outlook Survey from the Federal Reserve Bank of Philadelphia reported nearly flat business activity this month. The survey's indicators for general activity and new orders both improved from last month but recorded levels near zero.

U.S. stocks ended little changed Wednesday, as investors wait to see if stimulus measures from central banks across the globe will jumpstart the global economy.

"Investors are still reassessing the massive monetary stimulus, questioning how many short-term fixes we can handle before we really have to face up to our long-term imbalances," said Jack Ablin, chief investment officer at Harris Private Bank. "We're enjoying the party, but at some point, we're anticipating a hangover."

Related: Fear & Greed Index in 'extreme greed'

Companies: ConAgra Foods (CAG, Fortune 500) shares shot up nearly 7% after the food processing company reported better-than-expected earnings.

Investment bank Jefferies (JEF)also reported better-than-expected earnings before Thursday's open, but shares of the firm fell nearly 7%.

Several companies, including CarMax (KMX, Fortune 500), Rite Aid (RAD, Fortune 500) and Bed Bath & Beyond, (BBBY, Fortune 500)reported earnings below expectations, sending their shares lower.

Shares of railroad operator Norfolk Southern (NSC, Fortune 500) declined after the company lowered its third-quarter guidance late Wednesday. Fellow rail transport firms CSX (CSX, Fortune 500), Union Pacific (UNP, Fortune 500)and Kansas City Southern (KSU) also fell on the news.

Online real estate site Trulia (TRLA) raised $102 million through an initial public offering that priced at $17 a share - above its estimated rand. Shares, which began trading on the New York Stock Exchange Thursday, rose 38% from the IPO price.

Currencies and commodities: The dollar rose against the euro and British pound, but it fell versus the Japanese yen.

Oil for October delivery fell 15 cents to $91.83 a barrel.

Gold futures for December delivery fell $6.30 to $1,764.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.75% from 1.78% late Wednesday. ![]()

First Published: September 20, 2012: 9:44 AM ET

20 Sep, 2012

-

Source: http://rss.cnn.com/~r/rss/money_topstories/~3/E05L2vG59xU/index.html

--

Manage subscription | Powered by rssforward.com

Anda sedang membaca artikel tentang

Growth worries pressure U.S. stocks

Dengan url

http://classictaleoflife.blogspot.com/2012/09/growth-worries-pressure-us-stocks.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Growth worries pressure U.S. stocks

namun jangan lupa untuk meletakkan link

Growth worries pressure U.S. stocks

sebagai sumbernya

0 komentar:

Posting Komentar